Arkansas Reduces Personal, Corporate Income Tax Rates

June 26, 2024Arkansas has lowered its personal income and corporate income tax rates again.

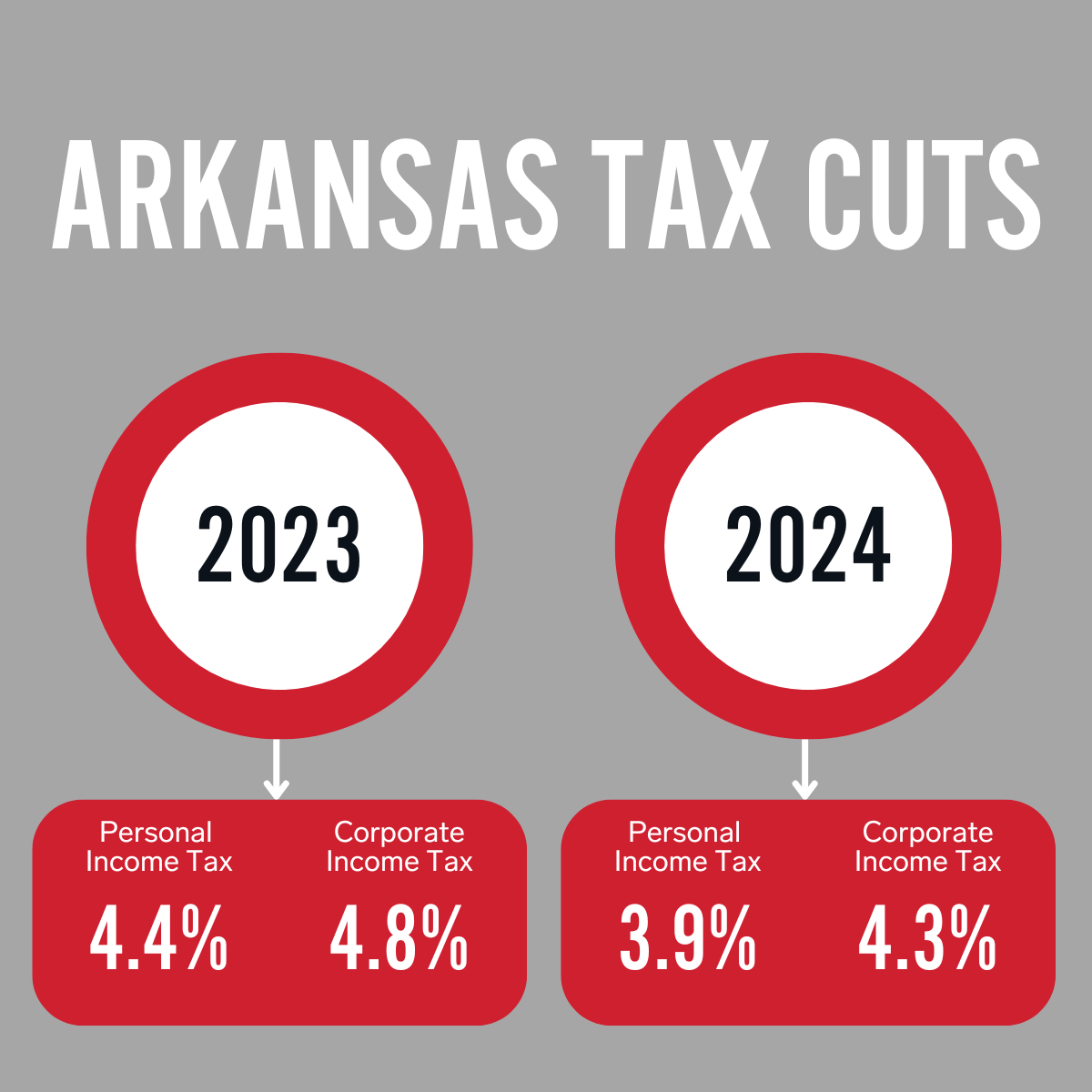

Under the leadership of Governor Sarah Huckabee Sanders, the Arkansas General Assembly passed legislation during a special session that cut the personal and corporate income tax rates. The legislation will lower the state’s top-end individual income tax rate from 4.4% to 3.9%, and it will lower the top-end corporate tax rate from 4.8% to 4.3%.

Both tax cuts are retroactive to January 1, 2024.

"We returned half a billion dollars to Arkansans today, lowering our income tax to 3.9%. Since taking office last year we have cut income taxes three times, and of the Southern states with an income tax, Arkansas now has the lowest,” said Governor Sarah Sanders

This is the third tax cut of the Sanders administration. In 2023, the General Assembly passed two tax cuts – one in the regular session and one in a special session. Since the beginning of Gov. Sanders’ administration in January 2023, the top personal income tax rate has dropped from 4.9% to 3.9% and the top income tax rate has dropped from 5.3% to 4.3%.

Taxes in Arkansas have steadily decreased since 2015. Legislators have cut taxes in each general session and multiple special sessions – reducing the top personal income tax rate from 7% and the top corporate income tax rate from 6.5% in 2015.